The North Bay and Area Realtors Association’s president says there is cause for optimism despite just 29 homes sold in December 2022 — a drop of 47.3 per cent from December 2021— as home sales fell to the lowest annual level since 2014

A few down months after nearly two years of record-setting real estate sales and prices were inevitable but, according to the North Bay & Area Realtors Association (NBARA), there is cause for optimism as the market settles to more sustainable levels.

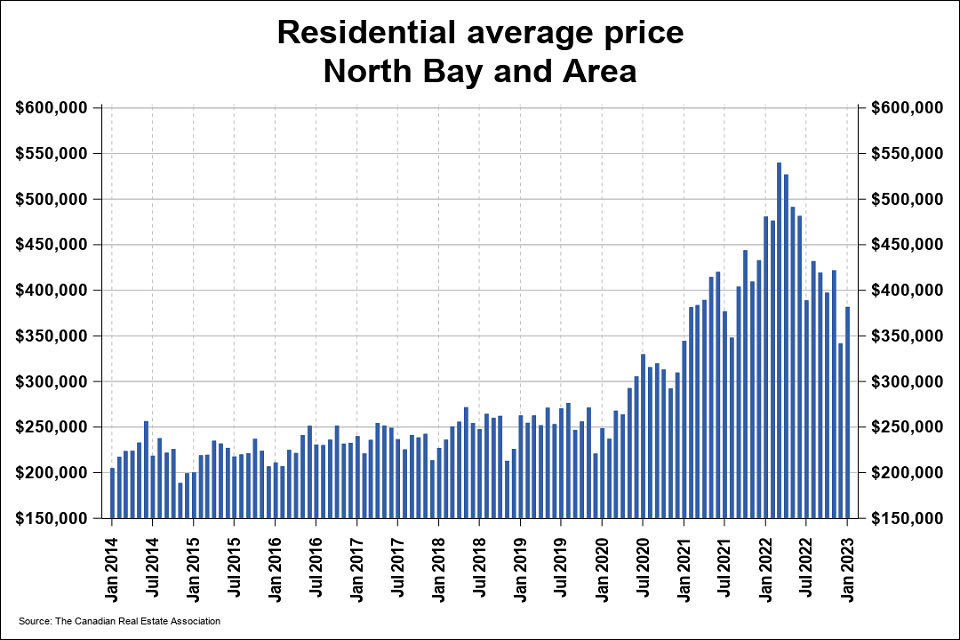

According to market data collected by the Canadian Real Estate Association (CREA), just 29 area homes sold in December 2022 — a drop of 47.3 per cent from December 2021— as home sales fell to the lowest annual level since 2014. See CREA’s January data here.

Established in 1957, the North Bay and Area Realtors Association (formerly the North Bay Real Estate Board) represents approximately 160 realtors and, centered in North Bay, covers an area bound by Mattawa to the east, Verner to the west, Powassan to the south and Temagami to the north.

“If you look at the previous two years, we’ve seen record prices, record sales and realtors were doing really well,” said Andre Purcell, NBARA’s president. On an annual basis, home sales totaled 1,146 units over the course of 2022. This was a substantial decrease of 25 per cent from 2021. “Then we saw the writing on the wall in September 2022 a little bit, then October, November we started seeing some declines, and then December some historic lows.”

The dip at the end of 2022 is evident. The average price of homes sold in December 2022 was $361,532, a decrease of 16.5 per cent from December 2021. However, on an annual basis, the more comprehensive CREA average price for 2022 was $462,441, an increase of 16.8 per cent from all of 2021 .The dollar value of all home sales in December 2022 was $10.5 million, a decrease of 56 per cent from December 2021.

Purcell advised after that sharp decline, according to preliminary data, “All numbers across the board were down but then as we got into January, things started turning around a little bit, so it looks like we have hit the bottom and we are going to see some leveling off into February and then through the spring, according to our projections, we’re going to see a little bit of an increase.”

According to CREA Chair Jill Oudil, “In 2022, we saw one of the biggest single-year shifts on record in Canadian housing activity, from record highs last winter to just below the 10-year average to end the year. That said, the market’s adjustments to higher rates may be mostly in the rear-view mirror at this point. That could start to bring buyers back off the sidelines this spring.”

In the last month of 2022, home sales were 39.3 per cent below the five-year average and 38.4 per cent below the 10-year average for the month of December.

Purcell says, “We’re starting to see some full offer scenarios again — not as much as we did last year but we’re starting to see them again and that’s primarily due to low inventory. There is not much on the market. People have grown accustomed to the interest rates. There was a drastic change from the third to the fourth quarter last year and people have gotten used to that and realized that’s the new norm.”

According to CREA, the number of new listings in December 2022 fell by 18.4 per cent (seven listings) from December 2021. There were 31 new residential listings in December 2022. This was the lowest number of new listings added for the month of December and was also the lowest number added for any month in history. New listings were 14.4 per cent below the five-year average and 42.7 per cent below the 10-year average for the month of December.

Active residential listings numbered 95 units on the market at the end of December 2022, more than double the levels from a year earlier, jumping 120.9 per cent from the end of December 2021. Still, active listings remained 18.5 per cent below the five-year average and 64.8 per cent below the 10-year average for the month of December.

Having reached the low point in the wake of the pandemic-driven real estate boom, Purcell and the organization remain positive despite the recent numbers. “I don’t think it’s a worry. Everyone, in all businesses, makes adjustments. We look at budgets and look to the future.”

Months of inventory numbered 3.3 at the end of December 2022, up from the 0.8 months recorded at the end of December 2021 and below the long-run average of 6.2 months for this time of year. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

Purcell says growth and an influx of home buyers have contributed to the low inventory. Options are limited for retired homeowners locally. “We’ve seen a little bit of growth in new construction and in-fill. But, people aren’t going to sell their homes if they don’t have a really good option to move to.”

All things considered, Purcell says, “There is no reason for panic. We’re just now in a normal, balanced market in which there is relative inventory versus the number of buyers who are actively looking. It just means changing your business model and adapting to that.”