Realtors’ fate depends on whether buyers and sellers return in force and how that will affect prices

Article content

At the height of the COVID-19 pandemic, when many of her peers were binge watching Netflix shows, Toronto’s Sewit Tamene decided she would finish getting her real estate license, a process she had started almost a decade earlier.

Advertisements 2

Article content

But by the time she completed the program in September 2022, the booming pandemic housing market had started to turn cold, with sales and new listings on the decline and prices rolling over, too. For Tamene, the timing was bad, but at least she still had a full-time job elsewhere. For her friends trying to launch careers in the industry, the transition has been more difficult.

Article content

“Maybe if they already had a history and they already had a client base and they were already sort of successful, it wouldn’t be hitting them as hard — but if you’re a newer agent, I definitely think that’s a little bit it’s more difficult to get going,” Tamene said. “Some realtors are definitely taking a pause or leaving the industry because there’s just not enough cake for everyone.”

Advertisements 3

Article content

The pressure on a swelling real estate profession — membership at the Canadian Real Estate Association (CREA) has risen 17 per since the end of 2020 to 160,000 while the number of brokers and salespeople represented by the Toronto Regional Real Estate Board is up 25 per cent since March 2020 — is just one of the storylines making this spring’s real estate market a make-or-break affair.

There’s just not enough cake for everyone

Sewit Tamene

The big questions, the ones that will decide realtors’ fate, are whether buyers and sellers return in force and how that will affect prices.

The Bank of Canada’s dramatic interest rate hikes over the past year have reshaped lending markets, making homes even less affordable and pushing many would-be homebuyers to the sidelines.

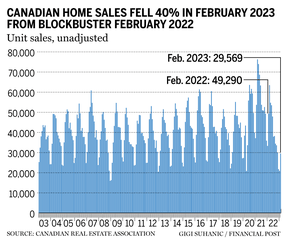

Figures released by CREA on March 15 show that actual (non-seasonally adjusted) transactions in February 2023 came in 40 per cent below a strong February 2022. New listings also continued to fall in February 2023, decreasing by 7.9 per cent month over month and hitting record lows in several cities, including Calgary.

Article content

Advertisements 4

Article content

Prices, too, have come under pressure. The composite benchmark price for a home in the Greater Toronto Area (GTA) peaked at $1,370,000 in March of 2022, according to figures from TREB, but as of February were down 18 per cent from there. Vancouver’s price decline has been steeper, according to the region’s real estate board, off 20 per cent from a high of $1,374,500 last April.

Industry observers have suggested the usually busy spring market might be the turning point that lures buyers and sellers back into the game, but that is hardly assured, and just where the balance of supply and demand lands will have significant consequences for the industry and the economy .

John Pasalis, president and broker of record at Toronto real estate brokerage, Realosophy, thinks demand has the upper hand. He said his brokerage has had lots of showings recently and that sales are growing faster than inventory. That is keeping the bidding process competitive and maintaining price levels, something he doesn’t see changing.

Advertisements 5

Article content

“We need to not just see a seasonal increase (in listings), but we need to see a big increase in the number of people coming on the market to sell — and we don’t know if that’s going to happen, to be honest with you,” Articleis said. “We’ll probably see some increase but I’m not sure if we’re going to see the level we need to bring a bit more balance to the market. And by balance, I mean, fewer bidding wars, homes sitting on the market a little bit longer.”

Pritesh Parekh, a Toronto realtor, said that while the lack of listings may be supporting prices, it is limiting the options for buyers.

“If a realtor is representing a buyer in this market, they’re definitely feeling the pressure of even finding homes that are suitable,” Parekh said. “And when they finally did find a property — and I’m talking more so houses than condos in this specific example — there were so many other buyers that were looking at that same home.”

Advertisements 6

Article content

For realtors, Parekh said the market has shifted dramatically since 2021, when one didn’t have to work full time to make ends meet.

“It was a market where properties were selling quickly and selling for high prices,” he said. “Part-timers doing lower volume sales or staying afloat based on the reality that there was a lot of businesses to go around, were selling properties relatively easily.”

Then, the market was buzzing from the Bank of Canada’s emergency interest rate cuts, sparked by the COVID-19 pandemic. The overnight rate sat at 0.25 per cent for all of 2021. A previously hot market seems to have gotten hotter that year.

“Properties were sold without being staged, without having repairs — even properties that had negative attributes were still selling at prices, people couldn’t believe it,” Parekh said.

Advertisements 7

Article content

As the Bank of Canada tightened monetary policy, the market thinned out and the “anything goes” mentality disappeared with it.

Parekh thinks this spring will show that buyers and sellers are tired of playing the waiting game.

“There were so many people who were looking to buy last year,” Parekh said. “And once prices started going down, they held off to see what happens next. There are still people in the market who have been waiting since last year, and at this point there’s going to be a segment of them who are tired of waiting and saying, ‘You know what, I’m ready to pull the trigger.’ ”

Adil Dinani, a realtor with Royal LePage West in Vancouver, has been selling real estate for 17 years and has seen three major market corrections. He said he was optimistic about the spring market and believed that “the worst is behind us.”

Advertisements 8

Article content

According to Dinani, entry-level price points of the Vancouver market are very active right now.

But he thinks a reckoning may be ahead for the industry, with less-established agents being winnowed out over the next few years.

“I think real estate practitioners need to work to provide value, to display market knowledge and really understand what’s happening out there (in real estate) because it’s a confusing time,” Dinani said. “If you’re a first-time buyer and rates are five and a half, six per cent, and prices have come down but not that much — you want to know where the opportunities in the market are.”

Despite the uncertainty, Tamene is optimistic the market will bounce back.

-

Mystery of a tiny Toronto laneway that sparked real estate drama

-

Death of the balcony: Outdoor space may soon be a luxury

-

How immigration, aging population will affect the housing market

“Things have been slower these past few months which can be discouraging,” she said. “I’m not a gambler but if I were placing a bet on Toronto and its real estate market, I’m going all in because that’s how confident I am that things will turn around.”

• Email: shcampbell@postmedia.com

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation