Insurance premiums for owners of brownstones and apartment buildings have gone up nearly 30 percent the last two years. Here’s how to make sure you’re getting the best deal:

Show what you’ve got: If you’re shopping for brownstone or apartment building insurance, Brownstone Agency invites you to share your current plan. “You show me what you’re getting now and I’ll show you how our coverage is more comprehensive at the price I’m offering you,” said Brownstone Agency marketing and sales agent Laura Allocco. “It’s part of our service. We’ll understand the coverage limitations that you currently have.”

Keep your brownstone or apartment building in good shape: Do you have updated wiring, clean gutters, and a great sidewalk shape? Brownstone and apartment building owners can get insurance credits to keep their properties immaculate. “We call it ‘good housekeeping,’ and it can save you up to 15 percent,” said Brownstone Agency managing director John Simone.

Lock in a three-year prepaid policy: Owners come to Brownstone Agency because of its three-year prepaid policy that allows you to lock in this year’s rate and not see an increase for three years. “It’s the number one reason why single and multifamily building owners come to us,” said Simone. “And no other insurance agency has that policy.”

To protect your investment, reach out to Brownstone Agency today and inquire about locking at a low rate with their three-year prepaid policy.

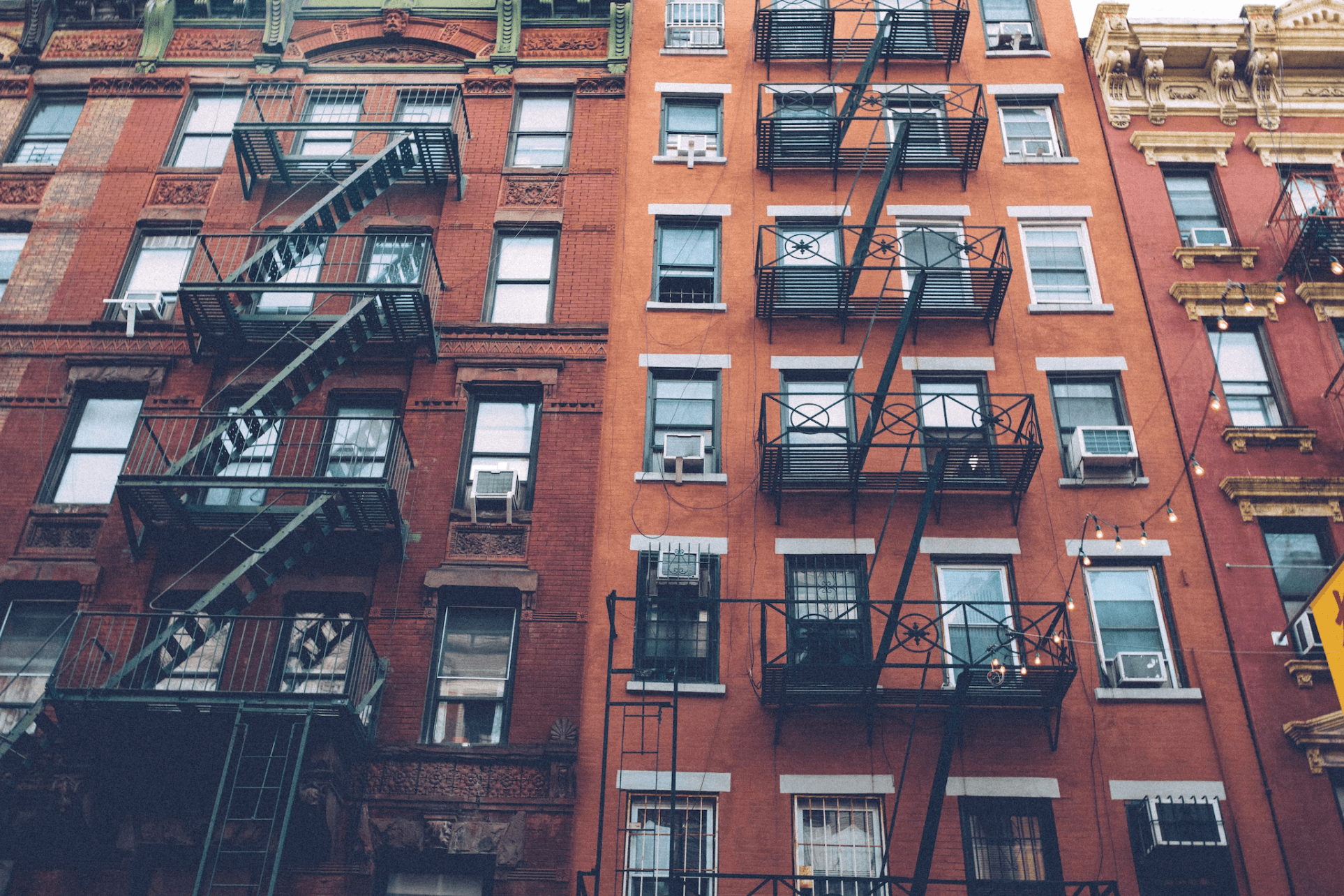

[Photos via Unsplash except where noted]